Energy Taxes on Heating

are distorting the market and inhibiting heat pump installations

in many European countries

The European Heat Pump Association – EHPA – has just published its Report on Energy Taxation in September 2021.

The report's key messages are:

- Heat pump technologies are best in class in energy efficiency, renewable energy, air quality and CO2 emission reduction.

- Despite the significant energy savings, heat pump operating costs can still be higher than fossil energy-based alternatives. This results from an imbalance in taxation levels and levies which favour fossil fuels and disadvantage electricity-based heating.

- Distorted energy prices are misleading consumers into the least sustainable heating technologies because they are currently the cheapest. However, the true cost of burning fossil fuels is borne by society at large.

- In the "fit for 55 package", the EU should ensure that customers are guided towards the cleanest, greenest and most sustainable heating systems by making it the economically most attractive heating option. The package should establish a CO2 price signal for heating and cooling including by reviewing taxation levels of all energy carriers, the introduction of a CO2 price and the phase out of fossil fuel subsidies.

Please see the full report: Report on Energy Taxation which finds that the tax price distortions against electricity are highest in the UK, Belgium and Germany.

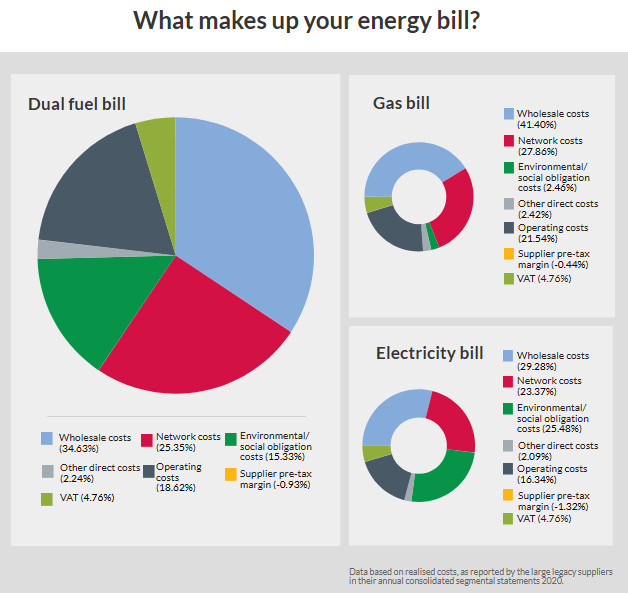

See also the Ofgem infographic on make up of gas and electricity bills:

Petition for UK to reduce its high taxes on electricity

If you believe the UK should reduce the market distortions caused by its excessive taxation of electricity compared to burning fossil fuels then please sign the petition to request government to reduce taxes on electricity – to allow heat pump installations.

The UK imposes 25.5% taxes on electricity, but only 2.5% on gas. These taxes are preventing the decarbonisation of heat in the UK. Government needs to switch taxes from electricity to gas to allow people to run heat pumps, to fight climate change, to encourage the long-term supply chain for heat pumps, reduce imports and support clean energy.

The UK cannot start to achieve 600,000 heat pump installations a year by 2028 until it reduces taxes on electricity – at least for those who install heat pumps.

Signing the petition is important if you agree to any of the following:

- you believe the government should encourage the reduction of carbon emissions

- you have a heat pump

- you might invest in a heat pump

- you install heat pumps

- you believe the government should support the UK supply chain for heat pump installations

- you believe the government should support the UK supply chain for drilling for ground source energy

- you believe the government should protect those on electric heating from heat poverty

- you believe we should reduce NO2 in cities to protect those suffering from respiratory diseases

- you believe we should reduce CO2 emissions to try to control climate change

How to sign

It is easy to sign the petition. All that is needed is to click on Reduce Taxes on Electricity to Allow Heat Pump Installations. Then click on "Sign this petition". You will then receive an email to which you must reply for your signature to be counted.

Already over 780 people have signed the petition. Please encourage your friends and contacts to sign as well!

Urgent Government Action Needed

The GSHPA believes that the government needs to reduce taxes on electricity to demonstrate that it is serious about fighting climate change, to drive for Net Zero carbon emissions and to support the decarbonisation of heat by encouraging the electrification of heating.

There are other actions that the government needs to take which are also important, although they may be secondary to the urgent need to reduce the taxes that are preventing people invest in heat pumps because they are waiting for a clear signal from government that they will save on the running costs of heating if they invest in heat pumps.

The other actions needed:

- to provide financial support for those who want to invest in clean heating to protect their community

- to increase the taxes on burning fuel for heating to discourage further carbon emissions

- to increase the taxes on burning fuel to discourage further NO2 emissions which compromise the health of those with respiratory diseases

Who should benefit?

Should the reduced taxes on electricity benefit everyone who uses electricity – or just those who have invested in a heat pump?

A reduction just for those who have invested in a heat pump would cost the government very little, and provide a greater incentive to those thinking of investing in a heat pump. Owners would need to declare their use of heat pumps to their electricity supplier – and maybe even provide an MCS certificate to qualify for tax free electricity.

Alternatively, if tax was reduced on all domestic electricity use the government could lose some £10bn of annual revenue. It could recoup the loss if it transferred the lower taxes on electricity onto higher taxes for those buying gas, oil and coal.

Have you signed the petition?

Please encourage your friends and family to sign too!

See Renewable Heating See Renewable Cooling